Table of Content

In fact, storm damage to gates and fences is a common exclusion. Not only can an insurer drop you after a single claim, it can drop you before you make any claims at all. Even asking about coverage but not filing it can be enough to panic an insurer into dropping you.

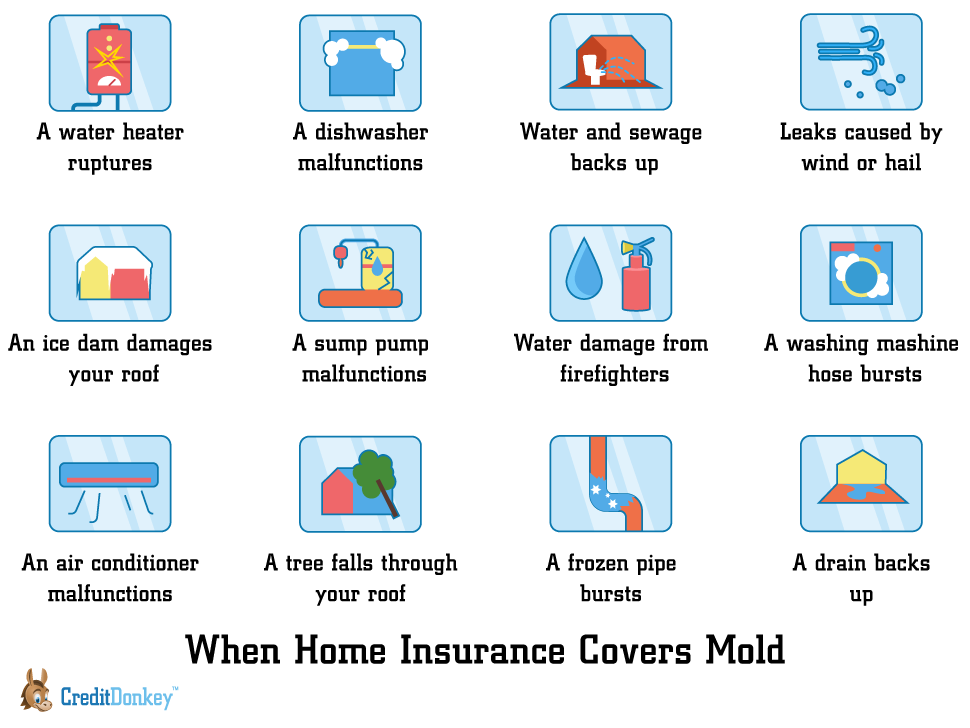

Your homeowners insurance company holds you responsible for performing the required maintenance around your home. It’s always a good idea to check with your insurance company to see what exactly is covered under your policy. That way, you’ll know what to expect if you ever need to file a claim.

Am I covered if a tree falls on my fence?

Review your policy specifics to see if you should seek out a windstorm insurance endorsement or your policy may already include a separate windstorm deductible for named storms. A “hurricane deductible” is typically 1 percent to 5 percent of your home’s insured value. Whether the tree was on your property or your neighbors, you can file a claim through your home insurance, since it was your property that was damaged. If your neighbor crashes their car into your fence, you’ll most likely be covered. However, it’s usually better to file the claim with the driver’s car insurance in this situation. After the accident, exchange insurance information with the driver — they’ll pay the damages with their liability car insurance.

Whether or not your fence is covered comes down to the small print and type of damage you're claiming for. IF your garden fence falls down, you might assume it's covered by your home insurance - but this isn't always the case. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.

When is fence damage not covered by homeowners insurance?

The resulting damage to your battered fence will likely be covered, but hopefully you and your neighbor are both taking steps to minimize the risk of tree damage to your property. It’s important to know the cause of your fence’s damage in order to understand if your insurance company would cover you or not. Your yard is a sanctuary — a place for relaxing, playing or letting the dog out. Damage to a fence is an annoyance that can take away from your space — luckily, Hippo can help restore your yard to its full potential by facilitating fence repairs painlessly and quickly.

You need to take pictures on several angles of the damaged area. Make sure the pictures you take will show what caused the damages. For vandalism and car damage (by other people’s car, of course), it may be supported by a police report. Call the police — If vandalism or a car collision was the reason for the damage, make sure to call the local police department and get a police report filed. A copy of this report should be filed with your insurance claim.

Does Homeowners Insurance Cover Vandalism?

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. What home renovations can change the amount of coverage you need? We cover six common scenarios that could affect your insurance, so you can plan ahead.

If your home insurance company finds that the fence was already falling apart because you were not maintaining it properly, coverage might be denied. Kacie Goff is a personal finance and insurance writer with over seven years of experience covering personal and commercial coverage options. She writes for Bankrate, The Simple Dollar, NextAdvisor, Varo Money, Coverage, Best Credit Cards and more. She's covered a broad range of policy types — including less-talked-about coverages like wrap insurance and E&O — and she specializes in auto, homeowners and life insurance.

Better Insurance. They Shop You Save.

Similarly, if you own the tree but you hadn’t taken steps to maintain and ensure its safety before it fell, it’s unlikely your insurance policy will pay out. The first step before making a home insurance claim is to make sure everyone is safe. If you need temporary fencing installed or emergency repairs done to make you and your household safe, let us know when you make your claim and we can organise a professional to come out ASAP. Fences – like all other parts of the home – aren’t covered if they weren’t in good condition or in an obvious state of disrepair before the loss or damage you’re claiming for occurred. We also don’t cover wear, tear or deterioration, and some losses where home extensions, alterations or renovations aren’t complete.

An Act of God is an accident or event resulting from natural causes without human intervention, and one that could not have been prevented by reasonable foresight or care. For example, insurance companies often consider a flood, earthquake or storm to be an Act of God. Having trees checked regularly and dead wood removed is the most responsible – and wisest – thing you can therefore do.

After the accident, call the police and exchange insurance information with the driver. Since they’re at fault, they may pay you for the damages through their car insurance. Well, the standard homeowners insurance policy will cover your fence, so you don’t have to worry about that. The only thing to keep in mind is that there’s unfortunately no insurance policy that’ll ever pay for your fence’s full replacement value up to its original cost.

Wind-related damage caused by storms or tornadoes, as well as damage caused by other covered disasters, will be covered by your insurance. If the cost of repairing your fence costs less than your deductible, you won't be able to file a claim. Whether or not your fence is covered will depend on what caused the damage in the first place. After giving them details of the incident, they will send you forms which you need to fill out for your insurance claim.