Table of Content

If a tree on your neighbor’s property – or some of its limbs – falls onto your fence and damages it, you may wonder how to deal with that damage. A standard homeowners insurance policy typically covers your fence if it is damaged by a sudden peril, like storms, fallen trees, or vandalism. However, your homeowners insurance policy will pay for repair costs up to the fence’s current cash value, not for the full replacement value of the fence’s original cost. Like cars, fences depreciate in value over time, due to wear and tear from being outdoors. Fences fall under the “other structures” coverage section of a standard homeowners insurance policy.

Let us talk about everything there is to know regarding this topic. So if your fence gets damaged by vandals or graffitied, your policy could pay out for the necessary repairs . Generally, if your tree falls onto your neighbor’s fence and causes damage, it would usually be covered by your neighbor’s insurance policy. Below, we’ll take a deep dive into the world of fences as they relate to your homeowners insurance. We’ll clarify which fence-related scenarios are likely covered by your insurance, and when you’ll have to pay for repair costs yourself. Once the damage has been assessed, you’ll want to determine whether or not it makes financial sense to file the claim.

Does Home Insurance Cover Fences?

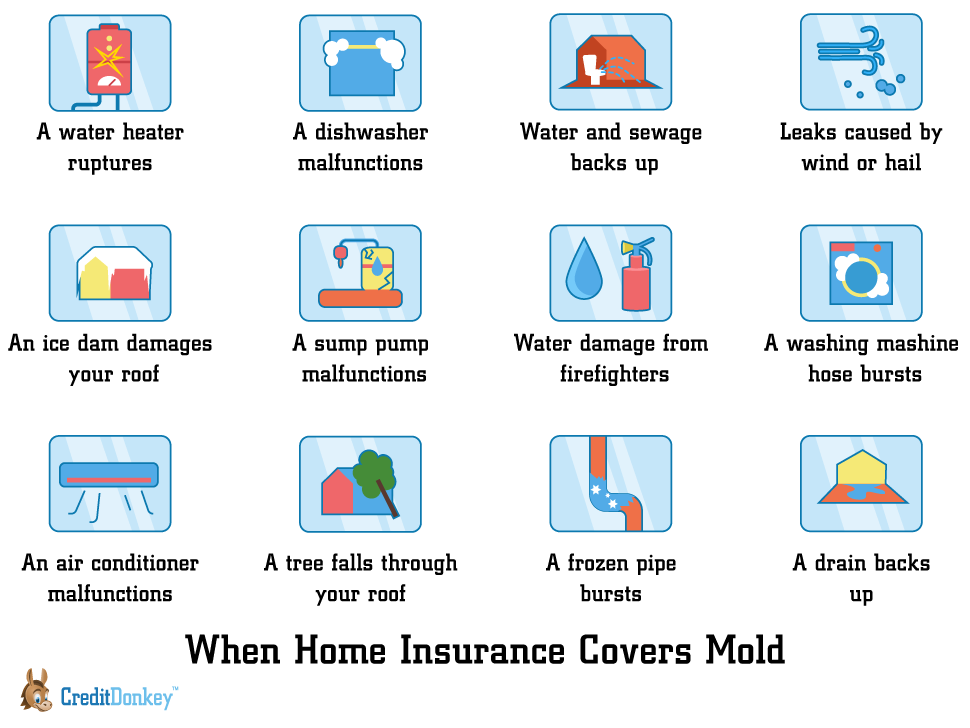

So it's important to read the small print on your paperwork to fully understand what is covered before claiming. Your coverage will not only depend on your insurer but also your specific policy. Many insurers require the gusts to have reached a certain windspeed or for rainfall to have got to a minimum level in your postcode before they'll pay out. And while you might assume that your insurer will cover the damage, this isn't always true.

Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. For example, if the home itself is insured for $250,000, the fence and other dwellings on the property would be covered up to $25,000. In both cases, you would still have a deductible apply in the event of the claim. This means that the deductible amount you chose will be deducted from your insurance provider’s claim payout amount. Our insurance team is composed of agents, data analysts, and customers like you.

What kind of fence damage is covered by home insurance?

If that’s the case, you likely need to purchase windstorm insurance. Generally, fences are considered other structures and are insured for up to 10% of your house's coverage limit. Most insurance companies apply depreciation to how much they'll pay to repair or replace a fence and your deductible will apply. Before filing a home insurance claim for fence damage, homeowners should take photos of the damage.

For information on more ways Hippo can help protect you and your home, get a home insurance quote today. There are a few other common scenarios in which your fence could be damaged, like by falling objects, but whether or not the fence would be covered is circumstantial. When getting a homeowners insurance, always remember to read all documents before you agree to by signing it.

If Your Neighbor’s Tree Falls on Your Fence

However, the average cost of homeowners insurance is $1,000 per year. To check if your homeowners policy has sufficient coverage or to get a quote from Travelers for homeowners coverage, contact yourlocal independent agent or Travelers representative. Trees can present a particularly significant danger during a storm. In all cases, keep in mind that you’d be responsible for your deductible before receiving any additional claim compensation. That means if your fence damage is minor, and the costs are less than your deductible, you’d be responsible for handling them out-of-pocket.

If you need to claim for any damage, typically covering the cost of this will fall under the car driver’s insurance. If the tree is on your property and it fell because of storm damage then, depending on your policy, you may not be covered. For example, your fence may initially be covered on your policy but not if it has been damaged in a storm, which is unfortunate for thousands of Brits whose fences were torn apart in Storm Eunice. If a fence isn't properly maintained and falls down or is devoured by termites, the homeowner is generally responsible for paying for the repairs. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website.

It’s natural behavior to immediately wonder if you can file for damages to your property when it happens. Filing an insurance claim, however, isn’t always the best route to go. Fence repair should be covered as long as your homeowners policy covers that peril or cause of the loss. Any vandalism damage that’s made to your fence or gates will fall under your buildings insurance. Yes, most home insurance policies will cover you for vandalism or malicious damage, even when you don’t know who the culprit is. You’ll be required to pay the excess if you want your insurance to help cover the costs of the repairs though.

If the cost of the repairs is lower than your deductible, you may want to pay out of pocket for the repairs to avoid higher insurance premiums in the future. If your neighbor’s tree falls on your fence, you’ll still file the claim with your own insurance company. Your insurance provider will open an investigation into why the tree fell. If the decision is that the tree fell due to your neighbor’s neglect, your insurance company will then work to get payment on your behalf. A standard homeowners insurance policy covers your fence under pretty much all the same scenarios as it does the rest of your property, or the actual dwelling of the home itself. Again, coverage will reimburse up to the fence’s current cash value.

Keep in mind, however, a homeowners claim involving a dilapidated fence might not get covered. The fence needs to have been in a good state of repair before the incident. A storm or tornado damaging your fence will likely get covered. A healthy tree falls on your fence should get covered if you file a claim.

Her work has appeared in MarketWatch, CNBC, PBS, Inverse, The Philadelphia Inquirer, and more. Save your receipts — If the damage is so severe that it needs emergency repair, save all receipts to submit to your insurance company after the fact. Call your agent — Alert your insurance agent or insurance company. They will walk you through every step of the way and should be able to answer any questions you have. As is the case with any insurance claim you file, you need to get every detail correct so that you can present a full picture and get the full extent of what you are owed.

No comments:

Post a Comment